Hunter Biden Was on Payroll of Credit Card Company That Benefited from 2005 Bill Pushed by Dad

One of the shortcomings when it comes to the reporting on the Hunter Biden scandal is that the emails recovered from his laptop are definitive proof that Joe Biden’s son was trading on his father’s name during and after the elder Biden’s tenure as vice president. This manages to be accurate while at the same time being wholly incomplete.

As far as most media outlets are concerned, whenever the conflicts of interest that Hunter Biden introduced into his father’s 2020 presidential run are discussed at all, it begins and ends with Burisma in Ukraine and his work with a Chinese investment firm. His qualifications for both roles were basically that he had the same last name as the vice president, and the emails on his laptop pull the Democratic nominee further into the morass.

There’s an implication it all began there, however, if there’s reporting on the rest of Hunter Biden’s career.

When Joe Biden jumped from being a Delaware senator winding down his career to being second in line to the presidency — that’s the moment Hunter began to cash in on his surname. Before then, he was just your average Washington kid in the private sector.

In fact, the story is that there never really was a time the prodigal Biden wasn’t trading on the family’s name.

Matthew Yglesias of Vox, sometimes given to uttering the truth, described Hunter Biden in an August article as a man who “never really seems to have quite launched as an independent entity.”

We could go through a blow-by-blow of how every major gig Hunter Biden has scored in his career seems to felicitously align with who his father is as opposed to what he can do, but there’s no better illustration of this than his relationship with MBNA.

Delaware, as you may be aware, is the most banking-friendly state in the nation. There’s a reason your favorite financial institution — and especially its credit card operation — is likely based in or around Wilmington, and it’s not because it’s the kind of hip, happening metropolis where young finance types aspire to move after college so they can make a fortune in the big city. (No offense to Wilmingtonians; I’m sure your city is a fantastic place with a vibrant local culture, but there’s a reason there isn’t a Frank Sinatra or Tony Bennett song about it.)

As Forbes notes, the state’s Chancery Court allows cases to be heard by judges, not juries; this means corporate cases are resolved in a much more expedient manner, a fact that had attracted plenty of companies to the state before 1978, when a court case allowed credit card companies to export interest rates from where they were based to other states.

Throughout the 1970s and 1980s, Delaware sped up the process of collecting financial institutions by giving banks and credit card providers tax breaks as well as the option to charge fees and to set interest rates on cards higher than other states would allow.

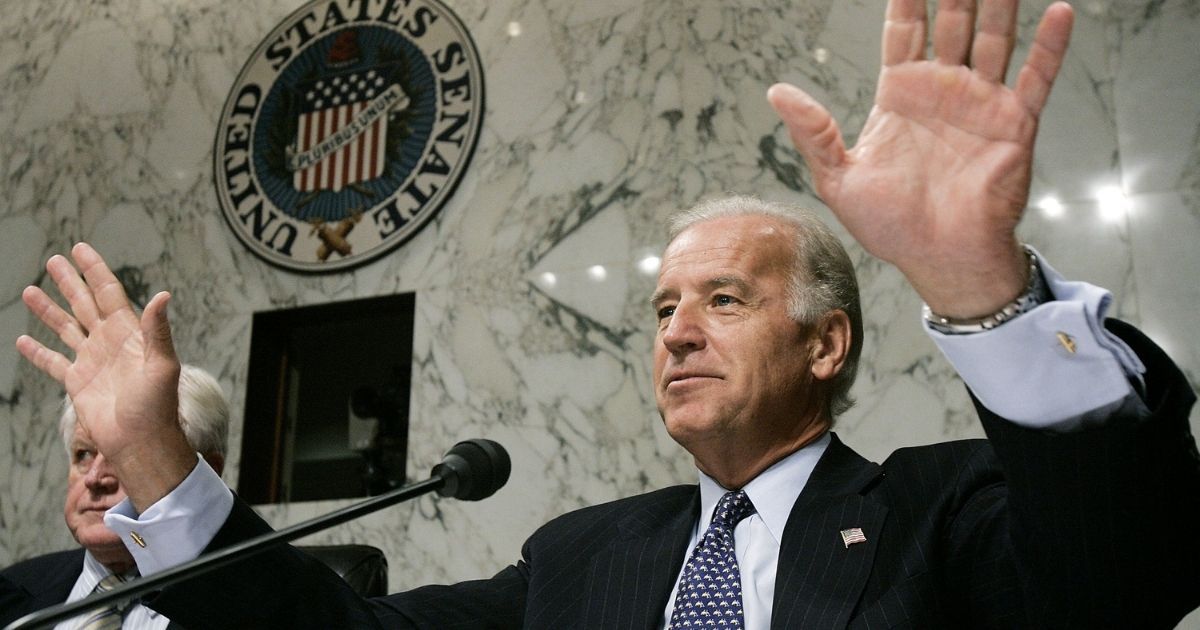

This engendered a close relationship between these companies and Delaware’s politicians, naturally. Few politicians enjoyed a closer relationship with a financial institution, however, than Joe Biden with credit card giant MBNA, a company later bought out by Bank of America.

In 1998, seven years before Joe Biden would etch his place in liberal infamy for his support of a bill that would make it significantly harder for Americans to discharge credit card debt in bankruptcy proceedings, Byron York wrote a story in The American Spectator about the senator’s entanglements with the company titled “The Senator from MBNA.” The name stuck, and for good reason.

The main offense York talked about in the article was the sale of Biden’s house to an MBNA executive for more than its market value.

There were a few sentences in the piece that didn’t garner much attention at the time, but 22 years on, they are what most readers will focus on.

“A few months after the sale, as Biden’s re-election effort got under way, MBNA’s top executives contributed generously to his campaign in a series of coordinated donations that sidestepped the limits on contributions by the company’s political action committee,” York wrote.

“And then, a short time after the election, MBNA hired Biden’s son for a lucrative job in which, according to bank officials, he is being groomed for a senior management position.”

It was, indeed, that son.

“Of course, lots of members of Congress have intimate ties to corporations in their states or districts. And lots of companies encourage their employees to make big campaign contributions (MBNA has given more to some Republicans than it gave to Biden). And certainly lots of children of influential parents end up in very good jobs,” York continued.

“But the Biden case is troubling because all those ingredients come together in one man — along with a touch of hypocrisy. After all, this is a senator who for years has sermonized against what he says is the corrupting influence of money in politics.”

According to The New York Times, Hunter Biden joined MBNA in 1996 and was made a senior vice president two years later before accepting a position in the Commerce Department during the Clinton administration. He would return as a consultant to MBNA in 2001 under a monthly consultancy contract on electronic banking, a contract that would continue until 2005.

That was the year the Bankruptcy Abuse Prevention and Consumer Protection Act was passed, a law supported by Biden. The legislation was exceptionally lucrative to MBNA because it made credit card debt more difficult to discharge in bankruptcy court — and, at that time, it was one of the biggest players in the field.

Nowadays, the bill is more controversial because it made it nigh impossible to discharge student debt — which made usurious, risk-free loans to students a popular proposition for financial companies, a stipulation now blamed by many for the student debt crisis.

According to Breitbart, the arrangement between Hunter Biden and MBNA wasn’t known at the time the bill was passed.

The contract became an issue for the first time when then-Sen. Joe Biden was picked by Barack Obama as his running mate; The Times’ article was the first to explore the relationship.

“Aides to Mr. Obama, who chose Mr. Biden as his vice-presidential running mate on Saturday, would not say how much the younger Mr. Biden, who works as both a lawyer and lobbyist in Washington, had received, though a company official had once described him as having a $100,000 a year retainer. But Obama aides said he had never lobbied for MBNA and that there was nothing improper about the payments,” The Times reported.

“Campaign officials acknowledged that the connection between the Bidens and MBNA, the enormous financial services company then based in their home state of Delaware, was one of the most sensitive issues they examined while vetting the senator for a spot on the ticket.”

Twelve years later, one of the less-savory aspects of this relationship — the fact that Hunter Biden’s employment situation always seems to have something to do with lobbying, access or (to be blunt) his last name — is coming back to haunt the Democratic nominee’s campaign just weeks before the biggest election of his life.

Joe Biden never liked his nickname, if you were wondering. “I’m not the senator from MBNA,” he said in 1999 when the first versions of what would eventually become the bankruptcy bill were being hashed out, according to The Washington Post.

I don’t know. It beats “The Senator from Burisma.”

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.

Advertise with The Western Journal and reach millions of highly engaged readers, while supporting our work. Advertise Today.