Federal Government Spending Hits All-Time High for First 10 Months of Fiscal Year

The federal government deficit for the first 10 months of fiscal year 2019 exceeded the previous year’s total shortfall and set an all-time record for total spending.

This result came despite revenues into the nation’s coffers increasing by 3 percent, Bloomberg reported.

Unfortunately, during the same time period, spending grew by 8 percent.

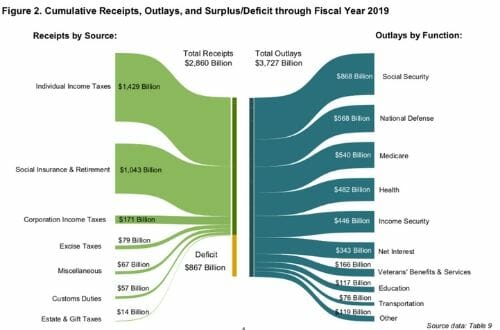

According to the Treasury Department, the government took in approximately $2.860 trillion while spending a record $3.727 trillion, for a deficit of $867 billion from October 2018 through July 2019.

That 10-month tally is more than last year’s entire deficit of $779 billion.

Though the deficit has grown, overall income tax receipts — both for individuals and corporations — have increased.

Receipts from individual taxpayers are up 1 percent, while the total for corporations has risen 3 percent.

Additionally, the tariffs imposed on China and other nations by President Donald Trump have led to a doubling of customs receipts to the Treasury to $57 billion.

The greatest source of revenue was individual income taxes, which netted $1.429 trillion so far this year.

The next was Social Security taxes at $1.043 trillion, followed by corporate income taxes at $171 billion.

Corporations also pay half of the Social Security taxes due for each of their employees.

Bloomberg reported that current deficits are caused by a combination of an aging population — placing a higher demand on Social Security and Medicare in particular — as well as the 2017 GOP tax cuts and an increase in defense and domestic discretionary spending.

Social Security is the largest outlay for the federal government at $868 billion for the first 10 months of this fiscal year.

The next highest expenditures are national defense at $568 billion; followed by Medicare, $540 billion; other health services like Medicaid at $482 billion; and income security payments, such as food stamps at $446 billion.

The net interest the federal government paid on the publicly held national debt is $343 billion.

In 2014, the Congressional Budget Office forecasted a return to high deficits in the years ahead, due to federal entitlement programs.

The CBO estimated an additional $7.6 trillion in deficits from 2015 to 2024, or an average of $760 billion per year.

The deficit in 2014 was $483 billion, meaning the CBO was anticipating a steep increase in revenue shortfalls over the decade, likely topping a trillion dollars per year.

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.

Advertise with The Western Journal and reach millions of highly engaged readers, while supporting our work. Advertise Today.