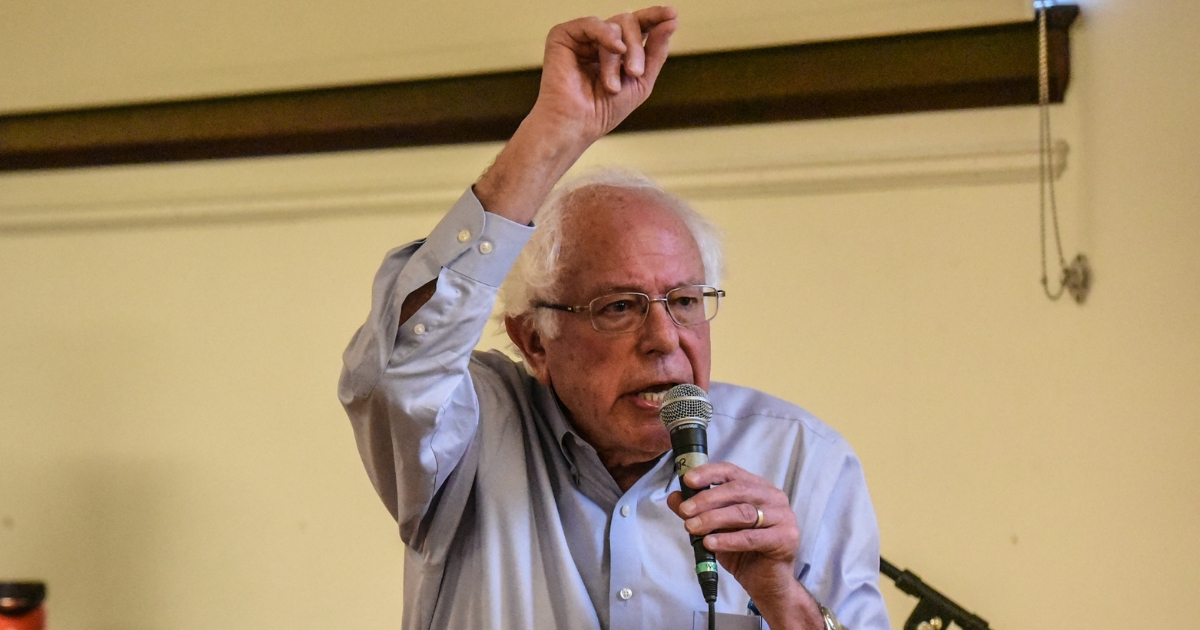

Bernie Sanders Proposes Top Estate Tax Rate of 77 Percent

Vermont Independent Senator Bernie Sanders is pushing for a sharp increase in federal estate taxes going as high as 77 percent on the value of estates over $1 billion, according to The Washington Post.

Sanders’ plan, which The Post referred to as the “For the 99.8% Act” is said to target only the wealthiest 0.2 percent of Americans.

“The fairest way to reduce wealth inequality, invest in the disappearing middle class and preserve our democracy is to enact a progressive estate tax on the inherited wealth of multi-millionaires and billionaires,” Sanders tweeted on Thursday.

The fairest way to reduce wealth inequality, invest in the disappearing middle class and preserve our democracy is to enact a progressive estate tax on the inherited wealth of multi-millionaires and billionaires.

Today I’m introducing a bill to do that:https://t.co/dDaCCgC2z5

— Bernie Sanders (@SenSanders) January 31, 2019

In a follow-up tweet, the senator broke down the tax rate based on estate dollar value.

According to Sanders tweet, estates worth $3.5 million to $10 million would be taxed at 45 percent and estates between $10 million and $50 million would be taxed at 50 percent.

Progressively, estates valued between $50 million and $1 billion would be taxed at 55 percent and estates over $1 billion would be taxed at 77 percent.

Our bill only applies to the richest 0.2% of Americans. It would establish a:

-45% tax on estate values $3.5M to $10M

-50% tax on estate values $10M to $50M

-55% tax on estate values over $50M

-77% tax on estate values over $1 billion— Bernie Sanders (@SenSanders) January 31, 2019

Sanders, who has been rumored to be a potential presidential contender in the 2020 election, introduced the bill on Thursday.

The legislation, if implemented, would bring in $2.2 trillion in taxes from the 588 billionaires in the United States, according to Bloomberg.

That $2.2 trillion would be taken from the $3 trillion combined net worth of the almost 600 billionaires in the United States.

Sanders’ progressive taxation plan is reminiscent of statements made by freshman Democratic Congresswoman Alexandria Ocasio-Cortez who floated the idea of taxing those who make more than $10 million at 70 percent just days after taking office.

Bernie Sanders is proposing an estate tax that would be the highest in over 50 years. https://t.co/lkGOTW4pv0 pic.twitter.com/BtzfWlHljy

— CNBC (@CNBC) January 31, 2019

Currently, the highest tax rate for estates is at 40 percent, however, Republican Senator John Thune, with the backing of Senate Majority Leader Mitch McConnell and others, has presented his own legislation that would do away with estate tax altogether, The Washington Post reported.

“It is literally beyond belief that the Republican leadership wants to provide hundreds of billions of dollars in tax breaks to the top 0.2 percent of our population,” Sanders said according to The Post.

“This is not only insane, it tells us the degree to which the billionaire class controls the Republican Party.”

“Our bill does what the American people want us to be doing and that is to demand that the very wealthiest families in this country start paying their fair share of taxes.”

Truth and Accuracy

We are committed to truth and accuracy in all of our journalism. Read our editorial standards.

Advertise with The Western Journal and reach millions of highly engaged readers, while supporting our work. Advertise Today.